A Step-by-Step Guide for Canadian Investors

In a dynamic real estate landscape where Canadian investors grapple with challenges, an increasing number are turning their gaze towards U.S. properties for the promise of equity growth and wealth generation. However, the path to success in cross-border investments is laden with complexities, from tax implications to financing logistics.

Enter SHARE: our comprehensive end-to-end service empowers investors to seamlessly build and grow their U.S. property portfolio from afar. In this article, we outline the fundamentals for Canadian investors eyeing U.S. real estate, shedding light on key considerations and showcasing SHARE's pivotal role in ensuring success.

Title Formation: How Will You Own Your American Real Estate?

Establishing how you will own your American real estate is a strategic decision that goes beyond legal formalities. It is a significant step in safeguarding your assets, mitigating risks, and ensuring a resilient foundation for your U.S. property investment journey.

SHARE's guidance in this critical phase reflects a commitment to empowering investors with the knowledge needed to navigate the complex terrain of cross-border real estate ownership.

Individual/Joint ownership: While offering flexibility and more favourable long-term capital gains rates, it comes with high risk and limited liability protection.

Limited Liability Company (LLC): Earnings are passed through to the individual(s), while the asset(s) is held and protected by the entity. This is very similar to a Limited Liability Limited Partnership (LLLP), but LLLPs tend to only be allowed for professionals (architects, engineers, lawyers, accountants, etc.) in some provinces.

Limited Partnership (LP): Earnings are passed through to the individual(s), while the asset(s) is held and protected by the entity.

Corporation: While assets are held and protected by the entity, earnings may be subject to double taxation since profits are taxed at the corporate level and, when distributed as dividends, may be taxed again at the individual level.

To navigate these complexities and minimize personal liability, SHARE strongly recommends forming a U.S. Limited Partnership (LP). An LP is a flow-through entity where the entity owns the asset, but income is earned by the individual(s) of that entity(ies). Investors can benefit from the personal asset protection features of an LP while filing taxes like individual ownership structures. Additionally, Limited Partnerships can also benefit from available tax credits.

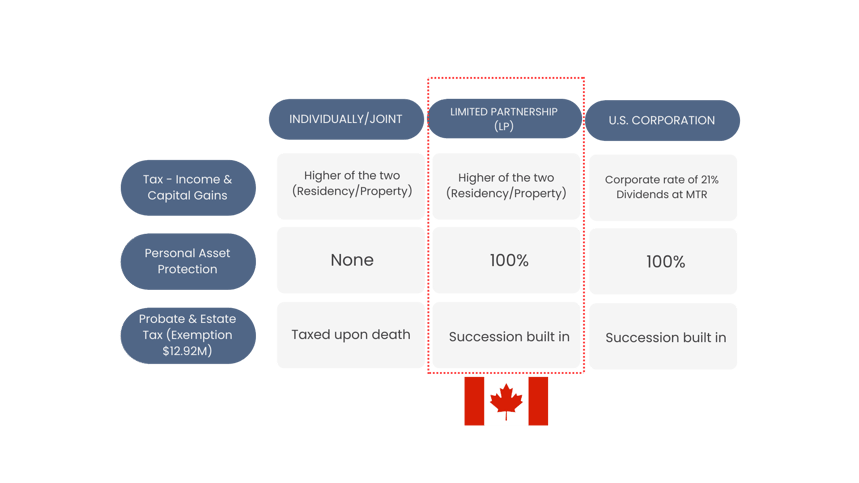

Tax Implications and Asset Protection Summary:

Financing Options: How Do You Fund Your American Properties?

Financing Options: How Do You Fund Your American Properties?

Securing financing for American rental properties as a Canadian investor is an important aspect of your cross-border real estate journey. The perceived challenges surrounding foreign investment financing can be daunting, but in reality, the process is more navigable than commonly believed (especially with SHARE’s guidance). Understanding the significance of funding and dispelling myths about the difficulty of qualifying for foreign investment financing is crucial for Canadian investors seeking success in the U.S. real estate market.

The significance of funding the growth of your rental portfolio cannot be overstated. Adequate financing not only facilitates property acquisition but also influences the overall profitability and success of your real estate venture. Key aspects include:

Optimizing Cash Flow: The right financing structure can positively impact your property's cash flow. Well-managed financing ensures that your income from rental properties exceeds your mortgage and operational costs, contributing to long-term financial sustainability.

Mitigating Risks: Proper funding mitigates financial risks associated with property ownership. It provides a buffer against market fluctuations, unexpected expenses, and economic downturns, fostering resilience in your real estate investments

Financing Options Tailored For Canadian Investors:

All Cash:

Myth: Transferring funds from Canada to the U.S. is overly complex.

Reality: For those seeking a straightforward, cash-based purchase, transferring funds is a viable option.Conventional Financing:

Myth: Traditional financing options are restrictive and challenging to obtain.

Reality: Conventional financing is extremely limited for Canadians to get “traditional” investment financing for the U.S. The few options are the U.S. arms of Canadian banks, and majority specialize in short-term rental properties.*Private Lenders:

Myth: Private lenders only cater to domestic investors.

Reality: Non-institutional lenders offer short-term, high-risk loans, providing a valuable alternative for Canadian investors who may not qualify for conventional financing.Cross-Border Financing :

Myth: Cross-border financing is excessively complex.

Reality: Designed specifically for Canadian investors, cross-border financing offers tailored solutions. However, it may require a higher down payment plus additional documentation and quality underwriting processes to execute.Debt Service Coverage Ratio (DSCR) Loans:

Myth: Financing decisions are solely based on credit worthiness.

Reality: DSCR loans assess the property's ability to cover its debt obligations, offering an alternative metric for evaluating financing eligibility, especially for cross-border real estate investments.✨ Home Equity Line of Credit (HELOC)✨:

Myth: Leveraging equity from Canadian property for U.S. purchases is fraught with challenges.

Reality: Canadians can tap into the equity they've built in their Canadian property through a HELOC, offering a strategic and cost-effective means of financing U.S. rental properties. This is the financing option that SHARE recommends for our Canadian investors, especially in the current high-interest rate environment. To request more information from our Canadian mortgage partners, please email us.>>> ✉️ Email SHARE Client Succes Team ✉️<<<

Which Market Should You Invest In?

Selecting the right market for your cross-border real estate investments is a significant decision that influences the success of your venture as a Canadian investor. For starters, SHARE assesses the locations’ landlord-tenant laws and applicable taxes, plus many other critical factors that we consider during underwriting.

Landlord-Tenant Laws: Navigating Legal Landscape For Success

Landlord-tenant laws vary significantly from state to state in the U.S., and their implications can be profound for all investors. These laws govern the rights and responsibilities of both landlords and tenants, shaping the dynamics of property management and influencing the potential return on investment.

Key considerations include:

Rent Control Measures: Some states and municipalities have implemented rent control ordinances to limit rent increases. Understanding the presence and extent of rent control is crucial, as it directly impacts the cash flow potential of your investment property.

Eviction Regulations: Legal procedures for eviction vary widely. Some states have stringent regulations favoring tenants, making it challenging for landlords to regain possession of a property. Awareness of eviction laws is vital for effective property management.

Property Maintenance Requirements: States may have specific requirements regarding property maintenance and habitability. Investors need to be aware of these standards to ensure their properties meet legal obligations.

Impact on Canadian Investors:

For Canadian investors, a thorough understanding of landlord-tenant laws is imperative for successful property management. States with more favorable regulations for landlords may offer increased flexibility and potential for higher returns (for example, Texas, Georgia, Tennessee, and Alabama). Conversely, regions with stringent rent control and eviction laws may pose challenges to cash flow and property management efficiency.

Applicable Taxes: Maximizing Returns Through Tax Optimization

As a foreign investor, understanding applicable taxes is crucial for maximizing returns and avoiding potential pitfalls. Taxes on property and income vary by state and locality, and Canadian investors must navigate both domestic and foreign tax regulations.

Key considerations include:

State-Level Income Taxes: Different states impose varying levels of income taxes.

Local Property Taxes: Property taxes also vary widely by location. Canadian investors should be aware of the local property tax rates in their chosen market, as these directly affect overall operating costs (these costs are factored into SHARE’s property calculators and underwriting).

Impact on Canadian Investors:

Navigating the tax landscape is essential for any investor seeking to optimize their returns and avoid unnecessary financial burdens. Consulting with tax professionals in both Canada and the U.S. can help investors develop tax-efficient strategies, minimizing the risk of double taxation and ensuring compliance with relevant tax laws.†

Ready To Start: How is SHARE Your Key To Success?

Read about our end-to-end services that make SHARE properties Turnkey+, or simply, book a call with our team to start your custom search.

>>> Book A Call 🗓️📞<<<

\

*Contact SHARE for our Canadian institution recommendation.

†There are many factors that affect your taxes, such as capital losses, depreciation, etc. It’s important to work with a professional to ensure compliance. SHARE offers centralized annual tax support and cross-border tax logistics for our investors.

.png)

.png)