SFRs: Not All Created Equal - Understanding Risk & Returns Are Essential for Smart Investment Diversification

The role of risk in Single-Family Rentals

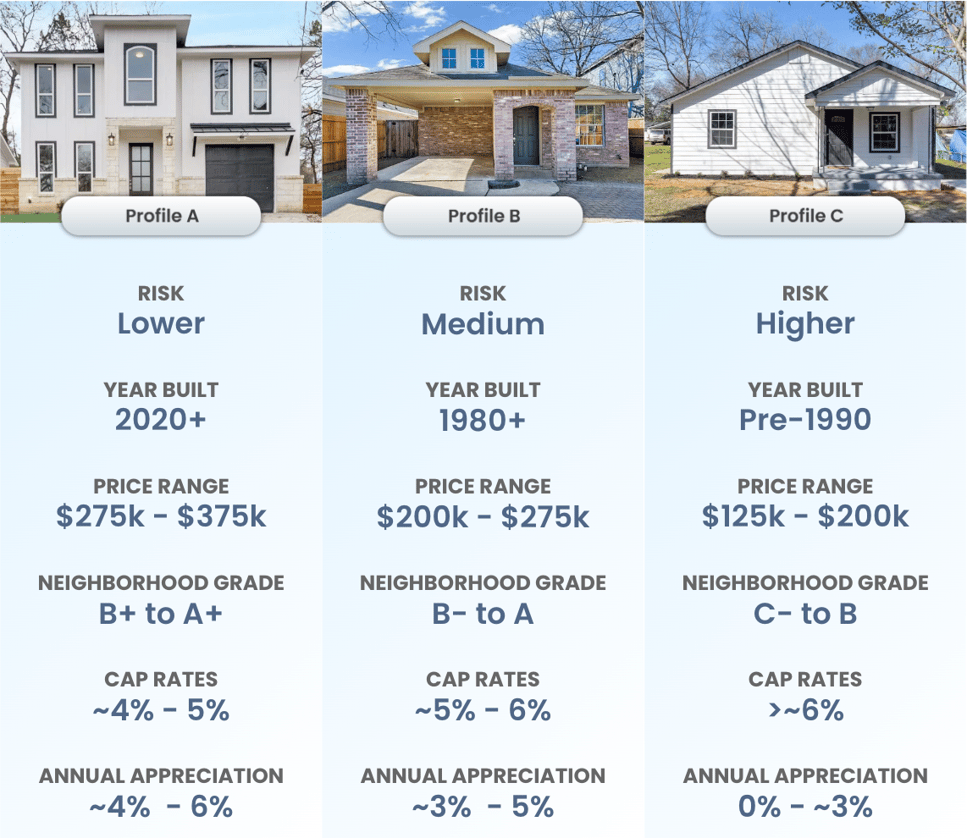

SHARE has identified 3 conceptual risk profiles that pertain to single-family rental properties: lower, moderate, and higher-risk investments. Depending on risk thresholds, SHARE can find properties tailored to different types of investors. We dive deeper into each profile below and discuss their expected returns, and what type of investor would be suitable for each profile. We have specified a handful of key economic metrics that SHARE considers when acquiring investment properties, and they are outlined in each risk profile to provide insights into their potential returns.

Profile Types*

* These profiles are conceptual, and represent SHARE’s guiding principles of each unique risk profile, without consideration of all the numerous factors that may affect investments, such as the unique features of local markets or the general quality of construction. It is important not to rely on any single metric when making investment decisions and in many cases, profile traits are blended across various geographies and specific property characteristics.

Key Economic Metrics**

We have specified 5 of the key economic metrics that SHARE considers when acquiring investment properties, and they are outlined in each risk profile to provide insights into their potential returns.

| Metric | Profile A | Profile B | Profile C |

|---|---|---|---|

| Neighborhood Grade | B+ to A+ | B- to A | D- to B |

|

Capitalization Rate ("Cap Rate"): The expected rate of return on an investment property. This metric is useful when comparing similar properties. Calculated as Net Operating Income (“NOI”) divided by the property’s purchase price.

Cap Rates |

~4% - 5% | ~5% - 6% | >~6% |

| Annual Appreciation | ~4% - 6% | ~2% - 4% | 0% - 2% |

|

Annual Net Operating Income (“NOI”) Growth: The annual percentage change in Net Operating Income as a result of changing operating revenues and expenses year-over-year. NOI is calculated by subtracting all reasonably necessary operating expenses from revenue. This is a before-tax figure.

Annual NOI Growth |

~5% | ~4% | ~3% |

|

Capital Expenditures ("CapEx"): Funds used to acquire, upgrade, and maintain the property. Expenditures can include reparations and maintenance work.

Annual Reserve for Capital Expenditures |

<~$350 | ~$350 - $1,000 | >~$1,000 |

| Metric | Profile A | Profile B | Profile C | |

|---|---|---|---|---|

| Neighborhood Grade | B+ to A+ | B- to A | D- to B | |

|

Capitalization Rate ("Cap Rate"): The expected rate of return on an investment property. This metric is useful when comparing similar properties. Calculated as Net Operating Income (“NOI”) divided by the property’s purchase price.

Cap Rates |

~4% - 5% | ~5% - 6% | >~6% | |

| Annual Appreciation | ~4% - 6% | ~2% - 4% | 0% - 2% | |

|

Annual Net Operating Income (“NOI”) Growth: The annual percentage change in Net Operating Income as a result of changing operating revenues and expenses year-over-year. NOI is calculated by subtracting all reasonably necessary operating expenses from revenue. This is a before-tax figure.

Annual NOI Growth |

~5% | ~4% | ~3% | |

|

Capital Expenditures ("CapEx"): Funds used to acquire, upgrade, and maintain the property. Expenditures can include reparations and maintenance work.

Annual Reserve for Capital Expenditures |

<~$350 | ~$350 - $1,000 | >~$1,000 | |

**The numbers used in each metric are approximations for example purposes.

Profile A

Risk: Low

Cash flow: Lower

Returns: Higher

Good for Investors with a long-term view that want to maintain maximum financing options at purchase and liquidity options throughout ownership and in the event of sale.

When investing in lower cap rate deals, properties initially produce less cash flow, but there is a higher potential for growth in the long term due to desirable locations and the lower necessity for repairs and maintenance. Properties that belong within Profile A are likelier to result in better long-term returns for investors (subject to the interest rate environment) at the expense of initial cash flows.

Profile B

Risk: Moderate

Cash flow: Balanced

Returns: Average

Good for newer investors looking to balance monthly cash-flow and capital appreciation, while also maintaining financing options at purchase and liquidity options throughout ownership and in the event of sale.

Striking the right balance between cash flow and appreciation through Profile B properties allows investors time to reap the benefits of cash flows from the property before further major renovations and capital expenditures are required. The liquidity options for Profile B properties allow investors to capitalize on refinancing to fund future expenditures or the demand from value-add investors in an event of sale, but likely not to the same extent as provided to investors of Profile A properties.

Profile C

Risk: High

Cash flow: Higher

Returns: Lower

Good for Investors looking for higher monthly cash flow while understanding the risk and resources required for extensive renovations and deferred repairs, and the inferior financing options at the time of purchase and overall inferior liquidity throughout ownership and in the event of sale.

Properties that belong within Profile C are likelier to require resources in excess of underwriting due to higher capital expenditures given the vintage and quality of construction. These higher-risk properties carry higher overall risk, as they have a lower potential for growth due to their overall lower quality, such as location, year-built, repairs & maintenance costs, however, Profile C properties have the potential to significantly outperform lower-risk properties in large part due to lower capital requirements initially at purchase, and amplified effects of better-than-expected appreciation.

Summary

It’s important to understand that the information presented in this article is conceptual and intended for explanatory purposes. As investors, we should strive for diversification of assets by investing across different risk profiles. Building a balanced portfolio is a high-effort task, which is why working with SHARE can be crucial to achieving investment success. With our expertise, we can build investors' portfolios and identify liquidity opportunities, as well as provide our clients with the tools and expertise they need to succeed in property investment. With our assistance, we believe that investors can achieve financial goals and secure a stable financial future.

%20(1).png)