Navigating the Shifting Tides of the U.S. Residential Market

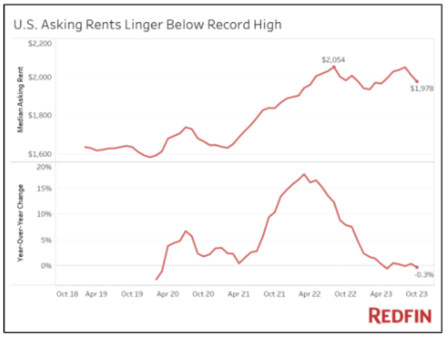

The U.S. residential market is a dynamic landscape, subject to various trends and shifts that can significantly impact investors. In recent months, one notable trend has been the slowdown in rent growth. While this might initially raise concerns among investors, a closer look reveals underlying factors that present opportunities for those with a long-term perspective.

Understanding the Slowdown in Rent Growth

In the ever-evolving world of real estate investment, the current slowdown in rent growth has become a focal point of discussion. At first glance, it might seem like cause for concern, especially in an already challenging high-interest rate environment. However, a nuanced understanding of this trend unveils a more optimistic perspective.

At first glance, the slowdown in rent growth raises red flags for investors heavily reliant on consistent rental income. The real estate sector's profitability is intricately tied to rental yields, and any apparent dip in this aspect may spark apprehensions among investors. One key factor contributing to the apparent slowdown is the seasonality of the rental market. Historically, certain points during the calendar year experience lower demand for rentals. This cyclical nature is a crucial aspect for investors to consider when interpreting short-term fluctuations. This cyclical nature is particularly pronounced after the summer leasing window, where fewer individuals are inclined to move. Investors need to recognize this seasonality as a natural phenomenon rather than a sign of a long-term downward trend in rental growth.

Moreover, the COVID-19 pandemic has introduced unique dynamics, influencing the timing and pattern of rental demand. Research conducted by Zillow suggests that pandemic-induced shifts in remote work trends have impacted when individuals choose to move, contributing to variations in rental demand throughout the year.

While acknowledging the short-term concerns associated with the slowdown in rent growth, investors must maintain a long-term perspective. According to a comprehensive analysis by Forbes, real estate is inherently a long-term investment, and fluctuations in rent growth should be viewed within the broader context of market cycles. Investors are encouraged to look beyond immediate challenges and focus on the resilience of the real estate market over time.

Unpacking the Supply and Demand Dynamics

Adding to the complexity of the situation is the reported discrepancy of 2.3 million homes in the United States. The shortage is a direct result of an increasing number of household formations and a decline in new construction.

Various factors contribute to the increasing demand for housing - including demographic shifts, immigration patterns, and the echo effects of the millennial generation entering key homeownership stages. However, while these market shifts play a large role, this isn’t the only problem.

More institutional real estate investors entering the market also contribute to the housing shortage in 2023. According to a 2022 report by the National Association of Realtors, institutional home buyers made up 13% of all residential home sales in 2021.

Contextualizing the current market scenario:

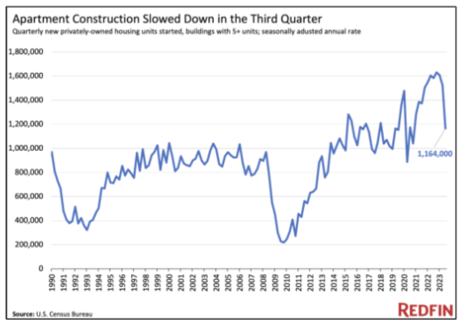

The COVID-19 pandemic caused supply chain issues, rising material costs, and labor shortages, all factors causing the decline in new construction. Simultaneously, developers are grappling with the intricacies of a high-interest rate environment, making capitalizing projects and ensuring profitability an uphill battle.

The U.S. housing shortage is not merely a statistical anomaly; it's a dynamic force shaping the residential market landscape. Understanding the magnitude of this issue is integral for investors seeking to navigate the complexities of supply and demand dynamics. While the market is experiencing a rent growth slowdown, housing shortage across the nation concurrently unveils strategic opportunities for investors with the foresight to embrace a long-term vision.

Key Takeaways for Long-Term Investors

In summary, the slowdown in rent growth, the decline in construction starts, and the housing shortage collectively create a complex yet intriguing market landscape. For long-term investors, understanding the interplay of these factors is crucial for making informed decisions.

Highlighting the Potential Opportunities

The challenges faced by developers and the growing home shortage create an environment where strategic investments can yield favorable returns over time.

Emphasizing the Importance of a Long-Term Perspective

Rather than being swayed by short-term fluctuations, focusing on the underlying fundamentals of supply and demand positions investors to navigate the shifting tides of the residential market successfully.

In conclusion, the U.S. residential market is undergoing a transformative phase. While these trends pose challenges, they also present opportunities for those with a discerning eye and a long-term investment horizon. Navigating these shifting tides requires a nuanced understanding of market dynamics, and investors stand to benefit by embracing a strategic, long-term approach.