1031 Exchange

Real estate is a proven way to accumulate wealth and achieve financial security, but it can come with a hefty tax bill. Enter: the 1031 exchange. This U.S. tax code aims to incentivize investors to move money forward to invest in more property. It allows investors to defer capital gains taxes on the sale of one property if the proceeds are used to purchase another like-kind property.

Capital gains: The tax that an investor has to pay based on the profits you make off an investment (stocks, bonds, real estate, or other investments) when it is sold. These taxes are owed during the year the investment is sold.

E.g. You purchased a house for $100,000 and sold the house the following year for $150,000, you have to pay a capital gains tax on the $50,000 profit that was made.Like-kind: Like-kind properties are real estate assets of a similar nature. Properties must be held for business or investment purposes but do not need to be similar in grade or quality.

In this article, we discuss:

- Benefits of using a 1031 exchange

- Important compliance rules

- Hypothetical scenarios of using the 1031 exchange, or paying capital gains taxes

- What happens after you stop deferring capital gains taxes

Benefits of a 1031 exchange

By using a 1031 exchange, investors can defer taxes on the sale of a property and use those funds to purchase another property. This can be especially helpful for investors who are looking to upgrade their real estate portfolio or move into a new market. Additionally, by deferring taxes, investors can keep more of their money invested in real estate, allowing it to grow over time.

Rules of compliance

It is super important to follow the specific rules of the 1031 exchange in order to qualify for the tax deferment. We highlight some of the key rules below:

- Important deadlines

The investor has 45 days from the closing of the relinquished property to identify the replacement property they intend to acquire for the exchange.

The investor has 180 days from the closing of the relinquished property to acquire the replacement property.

- 3-Property rule

There are rules to limit the number of properties the taxpayer may identify for the exchange. The taxpayer may identify up to 3 replacement properties and may acquire up to 3 of those identified properties.

- Greater or equal value replacement property rule

In order to make the most out of a 1031 exchange, investors should identify replacement properties that are of equal or greater value to the property being sold. You can do this by:

- Identifying up to 3 properties regardless of their value

- Identifying unlimited properties as long as the combined value doesn’t exceed 200% of the property being replaced

- Identifying unlimited properties as long as the properties acquired are valued at 95% or more of the property being replaced

- Manner of identification

The identification of the replacement properties must be done in writing and signed by the taxpayer. The identification notice is then sent to either the seller of the replacement property, or any other person involved in the exchange (such as the qualified intermediary, escrow agent, or title company).

These rules can be complex, and failure to adhere to them properly can result in challenges with the IRS and investors may end up having to pay capital gains taxes. This is why working with SHARE is beneficial by making the process hassle-free. Our Client Success Team has decades of real estate experience and tax expertise and will walk through each step of the process with you - from purchasing to leasing to refinancing and selling, and more.

📞 Schedule A Call With Us

1031 Exchange vs. Capital Gains Tax

Although this tax break may seem a little complicated to navigate, do not let the process deter you from reaping the benefits. Based on the scenarios below, you can clearly see the value difference between using the 1031 exchange (Scenario 1) and paying the capital gains tax (Scenario 2). The charts are based on 2 hypothetical investors who bought and sold properties over a 25-year span.

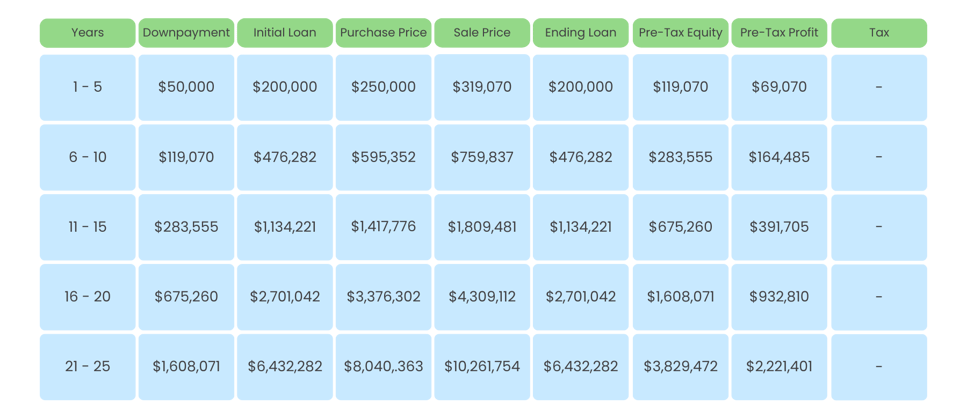

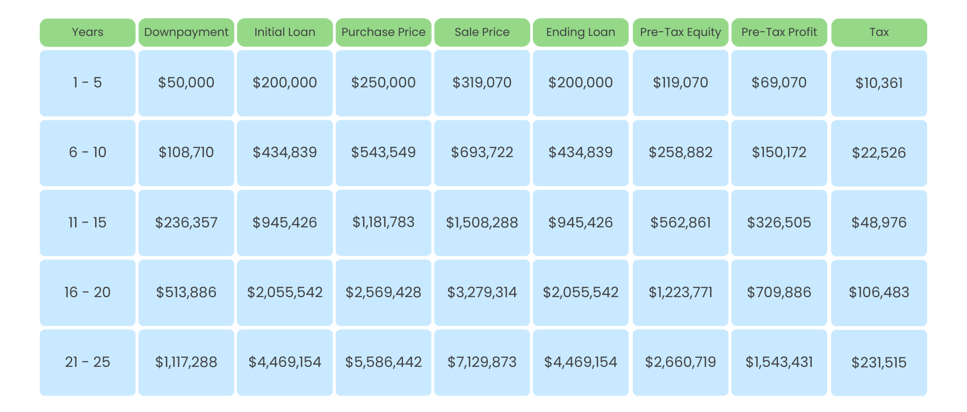

Assumptions to note for the 2 scenarios:

- Both scenarios start with the same amount of money ($50,000) and buy the same property ($250,000 purchase price)

- There are no principal payments (i.e. the loan is interest only) to the ending loan amount. The loan has to be paid off in full since the property is utilizing the 1031 exchange into the next deal.

- Both scenarios experience the same growth (5% equity growth each year)

- Both scenarios reinvest their profits as a 20% down payment on their next deal

- To illustrate a point, closing costs, depreciation, loan pay-down, cash flow, and other income/expense sources are not included in these calculations.

Scenario 1: Using the 1031 Exchange

Scenario 2: Paying capital gains tax*

*Note: the profit to reinvest is after paying an indicative 15% for capital gain taxes

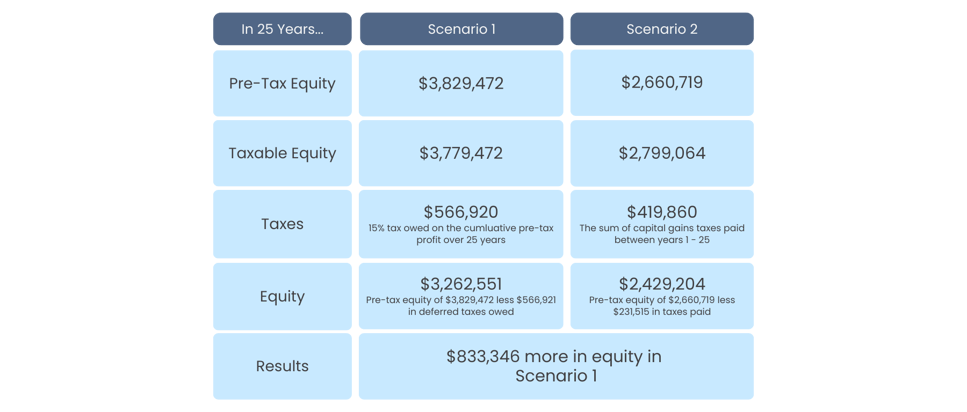

The following table summarizes the variance between the two scenarios when the investors decide to cash out after 25 years. Further below, we explain how cashing out is just one of the possible options for investors who utilized the 1031 exchange.

After 25 years, Scenario 1 resulted in over $800,000 more in equity than Scenario 2 as a result of having more money put to work through the investments due to the deferral of capital gains taxes by utilizing the 1031 exchange. This is despite having to pay ~$150,000 more in taxes after 25 years than what would have been paid cumulatively over 25 years without utilizing the 1031 exchange.

What happens after?

The 2 scenarios outlined above demonstrate the benefits of the 1031 exchange, and why many investors choose to take advantage of this tax code. But, deferred taxes only remain deferred until the investor sells their final property and does not use the proceeds to purchase another property. At that point, deferred taxes will be due and the investor will need to pay the IRS.

What are your options then? There are 3 common ways investors can choose to proceed:

1. Cash Out

The most straightforward option is to pay the taxes due, although it may be the least desirable as it typically results in large amount of money in taxes. Even so, utilizing the 1031 exchange results in over $800,000 more in net equity.

2. Pass it on:

Through estate planning, the property can be passed on to an inheritor. The inheritor receives the property on a "stepped-up basis" which is a current inheritance tax law that resets the asset's original cost basis to the value at date of inheritance.

Based on the example above, the original cost of the property was $250,000. On the date of inheritance, assumed to be in year 21, the last property used for the 1031 exchange was valued at ~$8,040,000. When the Inheritor decides to sell the property at the end of year 25 at ~$10,260,000, the inheritor only pays capital gains tax on the profit earned from $2,220,000†, and not based on the deferred cost basis of the initial $250,000 property.

3. Trade Up:

There are many trades investors can do on their final property. Investors can exchange their final property for shares in a REIT or a similar investment vehicle. Taxes remain deferred for as long as the shares are held onto in the REIT.

As real estate investors ourselves, we at SHARE understand the importance of maximizing eligible tax benefits and tax breaks when applicable. Our mission is to help more people achieve financial security through real estate, and part of our efforts in achieving that is to handle all of the headaches of property investments for them. Our services are unparalleled, offering institutional-grade asset management to every investor, whether you're a seasoned investor or a beginner.

In conclusion, the 1031 exchange can be a powerful tool for real estate investors looking to defer taxes and keep more of their money invested in real estate. Working with professionals to ensure compliance with the rules and regulations of 1031 exchanges is highly recommended.

Schedule a call with our Client Success Team today and let’s start the exchange process together.

†There are many factors that affect your taxes, such as capital losses, depreciation, etc. It’s important to work with a professional to ensure compliance. SHARE offers centralized annual tax support and cross-border tax logistics for our investors.

Appendix:The capital gains tax is the levy on the profit that an investor makes when an investment (stocks, bonds, real estate, or other investments) is sold. It is owed for the tax year during which the investment is sold. How capital gains are calculated: Determine the cost basis: The cost basis is the original price paid for the asset, including any additional expenses incurred during the purchase (e.g., commissions, fees). If the asset was acquired through inheritance or gift, the cost basis may be different. Calculate the capital gain: The capital gain is the difference between the selling price of the asset and its cost basis. If the selling price is higher than the cost basis, it results in a capital gain. If the selling price is lower, it results in a capital loss. When you have a capital loss, you can use it to offset capital gains in the same tax year. If your capital losses exceed your capital gains, you can use the excess losses to offset other taxable income, up to certain limits. Classify the gain: Capital gains can be classified as either short-term or long-term, depending on the holding period of the asset. If the asset was held for one year or less before selling, it's considered a short-term capital gain. If held for more than one year, it's classified as a long-term capital gain. Short-term capital gains tax is a tax applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains taxes are paid at the same rate as you’d pay on your ordinary income, such as wages from a job. Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate. Apply the tax rates: Short-term capital gains are taxed at ordinary income tax rates, which range from 10% to 37% (as of 2023). Long-term capital gains are subject to preferential tax rates, which depend on the taxpayer's income level and filing status. As of 2023, the long-term capital gains tax rates are 0%, 15%, or 20%, with higher rates for high-income earners. It is important to understand the definition of like-kind properties to determine whether you qualify for a 1031 exchange. According to the IRS, like-kind refers to the nature of the investment rather than the form*. Any type of investment property can be exchanged for another type of investment property. A single-family residence can be exchanged for a duplex; raw land for a shopping center; or an office for apartments. Any combination will work. The exchanger has the flexibility to change investment strategies to fulfill their needs. *What does not qualify for a 1031 exchange?

|

.png)